http://www.newyorkfed.org/research/staff_reports/sr512.pdf

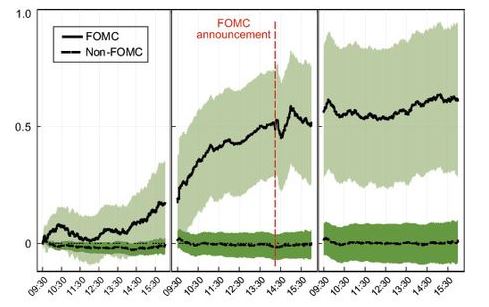

According to the research, which primarily looks at data from 1994 to near present, if you buy the S&P on the stock market open on the day prior to a Fed meeting, and sell about 15 minutes prior to the announcement at 2:15 the following day, you can have an average daily return of about .5%. Interestingly, if you remove the historical performance of these 8 days from each year going back to 1994, investing in the stock market wouldn't be so hot. I suppose the best strategy here would be to buy call options on the SPY or perhaps use a leveraged 3X fund (like SPXL) as the trading vehicle on those 8 instances.

My biggest concern with this strategy is the simple fact that the cat has been let out of the bag and generally strategies fail as soon as they are identified. The research report was dated 2011. There was not much difference between periods of tightening or easing.

In the chart below, the solid line is the market performance on Fed days and the dotted line is the average return on non-Fed days.

RSS Feed

RSS Feed