Disclosure: No position currently

|

I like seasonal patterns. One of the most reliable lately has been that gold bottoms around middle of December each year (a couple times in November) and then finds some rally legs in January. Why this has happened is anyone's guess... Some say it's because all the holiday gold jewelry buying worldwide, or recent dollar seasonality, or demand in India for weddings and such, or even the tax loss scenario - since the yellow metal has been in decline and you get the tax loss then buying pop in January (which is another one of my favorite seasonal trades in small cap stocks). At any rate a good trading vehicle for this (short term) is UGLD - a 3X gold long.

Disclosure: No position currently We got the big bounce I was looking for after yesterday and I sold some prior day's purchases (SPY and XLE). In other news, BOFI - Bank of Internet is now AXOS financial AX (but I am having a hard time using the new ticker/name after 12 years of BOFI) and released earnings yesterday. The numbers were not the greatest and stock is getting knocked down. First Internet Bank (INBK) had similar #'s at 61 cents for the Q but INBK has already been knocked down to below tangible book value and (hopefully) has little room to fall further. INBK is more of a value story and AX has recently been the big growth story. Unfortunately for AX their tangible book is $14.59/share which is a steep drop from current quotes around $27/share. INBK is trading around $25.50 with a tangible book of $27.80. Of course AX will most likely get their growth story back on track and therefore deserves a higher valuation (also AX has a much better ROA and ROE than INBK), however I won't be buying AX until the bloodbath and recession we are due for is in full force (of course leading economic indicators state I will be waiting awhile for that to happen). Remember that the yield curve will probably invert some time after January 1st which means these banks will have a harder time with their margins. Also when the inevitable recession hits the loan loss reserves go way up, knocking earnings down to scraps (and possible negative #'s). So I feel safe trading (and possibly building positions) in INBK but not yet for AX.

Disclosure: Long INBK (may buy more or sell at anytime) The market is crashing again and I am buying again. First Internet Bank - INBK reported a decent Q after hours today showing 61 cents for the quarter and most importantly (to me anyway) is that tangible book value is now up to $27.80/share. The last print today was $24.38 so the discount is fairly obvious. I did some INBK buying during market hours and expect to add more tomorrow. I also could not help myself and bought some energy names and some SPY. The markets are getting pretty ugly at this point and I'm looking for a bounce. On the economic and earnings front things are still looking pretty darn good. Housing is a weak spot but historically that sector is a very far leading economic indicator (like it can fall one to two years before bear markets/recessions begin). However, I do have to remind myself to trade very small (I'm currently 80% cash) as there is still a slim chance that I'm picking up pennies in front of the proverbial steam roller here.

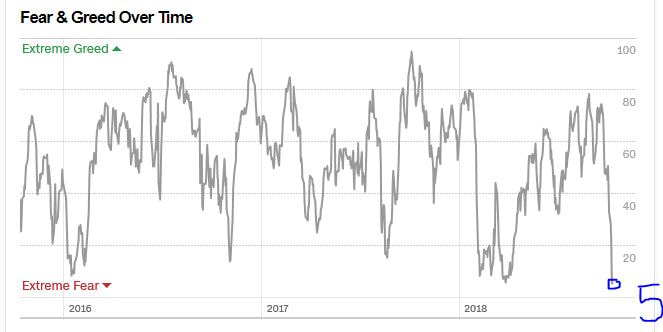

Well the markets have been pretty much crashing the last couple days and there is palpable fear now. The CNN Fear and Greed index is down to about 5 today (the lowest I have ever seen it) and therefore I have to do some buying. I don't want to and it goes against every fiber in my soul but I still believe (according to leading economic indicators) this bull market is not dead yet. So I will get long a little here while everyone else seems to be selling.

The S&P is down a couple percent since I last said it may be safe for a short trade for the first time in awhile. Some are saying it's all about the long end of the bond market finally selling off causing yields to rise. The 10 year broke through to as high as 3.24%. The yield curve is actually wider at this point which subsequently takes us farther from a "recession is imminent" signal and we remain "economy is booming" or in other words "forget about a bear market"! The Nasdaq and small cap Russell did get hit hard here and may fall a couple more percent in the next week or two, but I am actually more fearful of a rip-your-face-off rebound now. Basically I'm a once bit, twice shy short seller, with his tail between his legs - but it's still just the first week of spooky October and anything can happen at this point. Fundamentally, the market is generally obscenely overvalued on many metrics and could snap like a twig. Also, the elections are just a month away now so we may see more profit taking on the lead up. But looking out a little further I can't imagine not having the seasonal last quarter rally, especially when all the indicators are showing systemic ebullience, like consumer confidence at all time highs and job market "best ever!". Of course those things could also be the "as good as it gets" signal so 6 months from now we may sing a different tune.

On a side note - Bank of Internet (BOFI) is now Axos Financial (AX). I don't currently own it but it's on my wish list for when the stuff hits the fan, someday in the (hopefully) not too distant future. I will put together my full wish list/watch list sometime here (for longer term stock investments). |

Paul SaadSenior Manager, Paul Saad and Associates, LLC Archives

May 2020

Categories |

RSS Feed

RSS Feed